2 December 2019

Melbourne, Australia – Opthea Limited (Opthea or the Company) (ASX: OPT), a clinical-stage biopharmaceutical company developing novel biologic therapies to treat back-of-the-eye diseases, today announced that the company has received commitments from sophisticated and institutional investors in Australia and the United Kingdom to raise A$50 million via a private placement

(“Placement”).

The proceeds from the Placement will be used to fund further activities to support the late-stage clinical development of OPT-302 as a therapy for wet Age-related Macular Degeneration (wet AMD), including the manufacture of sufficient quantities of clinical grade OPT-302 for Phase 3 clinical development and the commencement of two concurrent Phase 3 pivotal registrational trials in wet AMD patients.

“This institutional placement of A$50m at this time strengthens Opthea’s cash position as we explore a number of strategic development opportunities, and enables the Company to fund its operations into the first half of calendar year 2021. The completion of this placement will allow Opthea to expeditiously progress our Phase 3 clinical development program with OPT-302,” commented Dr Megan Baldwin,

CEO & Managing Director, Opthea Limited.

The financing follows the recent reporting of outcomes from Opthea’s Phase 2b clinical study in which OPT-302 combination therapy demonstrated statistically significant and superior gains in visual acuity compared to ranibizumab (Lucentis®) monotherapy at 24 weeks in a trial of 366 treatment-naïve wet AMD patients.

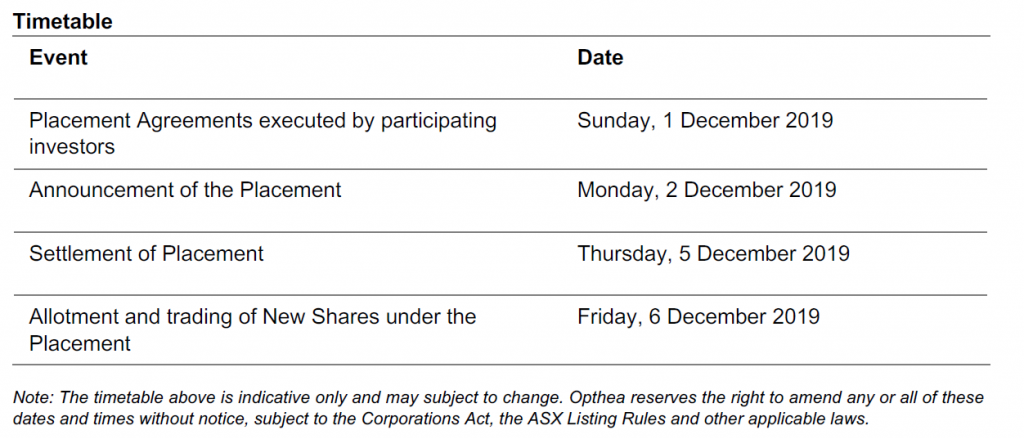

Placement Details

The Placement was conducted at a fixed price of A$2.65 per New Share, representing a 5.9% discount to the 15-day VWAP and a 3% discount to the closing price of A$2.73 on 29 November 2019. A total of 18.9 million fully paid ordinary shares (New Shares) will be issued under the Placement, representing approximately 7.5% of current issued capital.

New Shares issued under the Placement will have the same terms and rank equally with Opthea’s existing fully paid ordinary shares.

No shareholder approval is required for the Placement, as the Company will utilise a portion of its existing placement capacity under ASX Listing Rule 7.1.

Further details of the Placement, and Opthea, are set out in the Equity Raising Presentation accompanying this release.

Authorised for release to ASX by:

Mike Tonroe

Chief Financial Officer and Company Secretary

Phone: (D) +61 3 9829 7513; (M) +61 415 750 996

mike.tonroe@opthea.com

Megan Baldwin, PhD

CEO & Managing Director

Phone: (M) +61 (0) 447 788 674

megan.baldwin@opthea.com

About Opthea Limited

Opthea Limited (ASX:OPT) is a biologics drug developer focusing on ophthalmic disease therapies. It controls exclusive worldwide rights to a significant intellectual property portfolio around VEGF-C, VEGF-D and VEGFR-3. Opthea’s intellectual property is held within its wholly-owned subsidiary Vegenics Pty Ltd.

Opthea’s product development programs are focused on developing OPT-302 for retinal eye diseases including wet Age-related Macular Degeneration and Diabetic Macular Edema (DME). OPT-302 is a soluble form of vascular endothelial growth factor receptor 3 (VEGFR-3) or ‘Trap’ molecule that blocks the activity of two proteins (VEGFC and VEGF-D) that cause blood vessels to grow and leak, processes which contribute to the pathophysiology of retinal diseases.

Opthea is developing OPT-302 for use in combination with inhibitors of VEGF-A and has reported outcomes from an international, multi-centre, prospective, sham-controlled, double-masked, superiority study that enrolled 366 treatment-naïve patients with wet AMD. Participants in the study were randomized in a 1:1:1 ratio to receive one of the following treatment regimens administered every 4 weeks for 24 weeks: OPT-302 (0.5 mg) in combination with ranibizumab (Lucentis®) (0.5 mg); OPT-302 (2.0 mg) in combination with ranibizumab (0.5 mg); or sham in combination with ranibizumab (0.5 mg). The study met the primary endpoint demonstrating superior vision gains in participants who received OPT-302 (2.0 mg) in combination with ranibizumab on a monthly basis over 6 months.

Opthea is also investigating OPT-302 in a Phase 2a clinical trial in patients with persistent, centre-involved DME.

Further details on the Company’s clinical trials can be found at: www.clinicaltrials.gov, Clinical trial identifiers:

NCT02543229, NCT03345082 and NCT03397264.

Inherent risks of investment in biotechnology companies

There are a number of inherent risks associated with the development of pharmaceutical products to a marketable stage. The lengthy clinical trial process is designed to assess the safety and efficacy of a drug prior to commercialisation and a significant proportion of drugs fail one or both of these criteria. Other risks include uncertainty of patent protection and proprietary rights, whether patent applications and issued patents will offer adequate protection to enable product development, the obtaining of necessary drug regulatory authority approvals and difficulties caused by the rapid advancements in technology.

Companies such as Opthea are dependent on the success of their research and development projects and on the ability to attract funding to support these activities. Investment in research and development projects cannot be assessed on the same fundamentals as trading and manufacturing enterprises. Therefore investment in companies specialising in drug development must be regarded as highly speculative. Opthea strongly recommends that the investor presentation released on the date of this ASX announcement be carefully reviewed (including the “Key Risks” section and that professional investment advice be sought prior to such investments.

Forward-looking statements

Certain statements in this ASX announcement contain forward-looking statements regarding the timetable conduct and outcome of the Placement and the use of the proceeds thereof, the Company’s business and the therapeutic and commercial potential of its technologies and products in development. Forward looking statements may be identified by the use of words like ‘anticipate’, ‘believe’, ‘aim’, ‘estimate’, ‘expect’, ‘intend’, ‘may’, ‘plan’, ‘project’, ‘will’, ‘should’, ‘seek’ and similar expressions. Any statement describing the Company’s goals, expectations, strategies, intentions or beliefs is a forward-looking statement and should be considered an at-risk statement.

Such statements are subject to certain known and unknown risks and uncertainties and other factors, particularly those risks or uncertainties inherent in the process of developing technology and in the process of discovering, developing and commercialising drugs that can be proven to be safe and effective for use as human therapeutics, and in the endeavour of building a business around such products and services. Refer to the ‘Key risks’ section of the investor Equity Raising Presentation referenced in this ASX announcement for a summary of certain risk factors that may affect Opthea. Many of these risks and uncertainties will be outside the control of the Company and its directors and management, and may involve significant elements of subjective judgment and assumptions as to future

events that may or may not be correct.

No representation, warranty or assurance (express or implied) is given or made in relation to any forward-looking statement by any person (including Opthea and any of its subsidiaries or any of the respective directors, officers, employees, representatives, agents or advisers of Opthea or its subsidiaries (Opthea Related Persons)). In particular, no representation, warranty or assurance (express or implied) is given that the occurrence of the events expressed or implied in any forward-looking statements in this ASX announcement will actually occur. The forward-looking statements in this ASX announcement speak only as of the date of this ASX announcement. Subject to any continuing obligations under applicable law or any relevant ASX listing rules, the Company and Opthea Related Persons disclaim any obligation or undertaking to provide any updates or revisions to any forward-looking statement, whether as a result of new information, future events, or otherwise.

Actual results could differ materially from those discussed in this ASX announcement.

Not an offer

This ASX announcement is not a disclosure document and should not be considered as investment advice. The information contained in this ASX announcement is for information purposes only and should not be considered an offer or an invitation to acquire Company securities or any other financial products and does not and will not form part of any contract for the acquisition of New Shares.

In particular, this ASX announcement does not constitute an offer to sell, or a solicitation of any offer to buy, any securities in the United States or any other jurisdiction in which such an offer would be illegal or impermissible. The securities to be offered and sold in the Placement have not been, and will not be, registered under the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”), or the securities laws of any state or other jurisdiction of the United States. Accordingly, the securities to be offered and sold in the Placement may only be offered and sold outside the United States in “offshore transactions” (as defined in Rule 902(h) under Regulation

S of the U.S. Securities Act (“Regulation S”)) in reliance on Regulation S, unless they are offered and sold in a transaction exempt from, or in a transaction not subject to, the registration requirements of the U.S. Securities Act and applicable U.S. state securities laws. This ASX Announcement may not be distributed or released in the United States.